The Experiment:

A Unique Small Business Family Office Approach

This is a general outline to explain the basic idea.

The basic concept is a comprehensive financial planning firm that is designed to support small business owners on their path to accumulate generational wealth. The firm is focused around the financial planner, with other professionals contracted in as part of the internal team. This starts with the standard financial and professional services that can be considered part of the "standard model," and will expand to include additional services that facilitate creating the generational wealth. Having these services provided collectively from an inhouse team is what makes this process streamlined and efficient. Providing the additional services as part of this team is what makes this approach stand out as uniquely valuable.

Phase 1 - Standard Model

The business owner is working with a financial planner. This is a basic relationship, mostly centered around retirement planning, investments, and maybe some tax strategy.

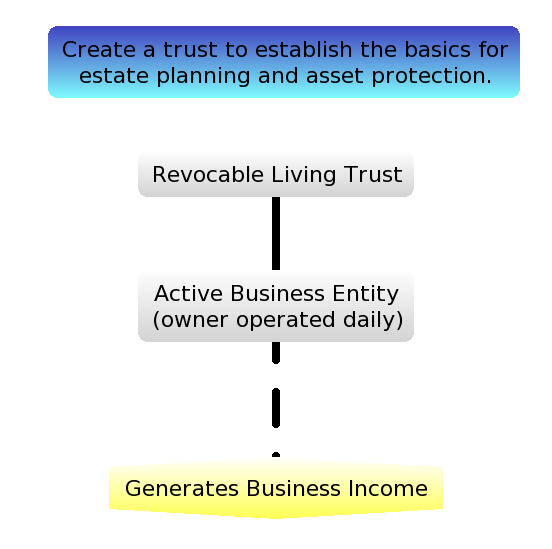

Phase 2 - Standard Model

The services expand to include estate planning, so a trust is formed. This includes a basic level of asset protection.

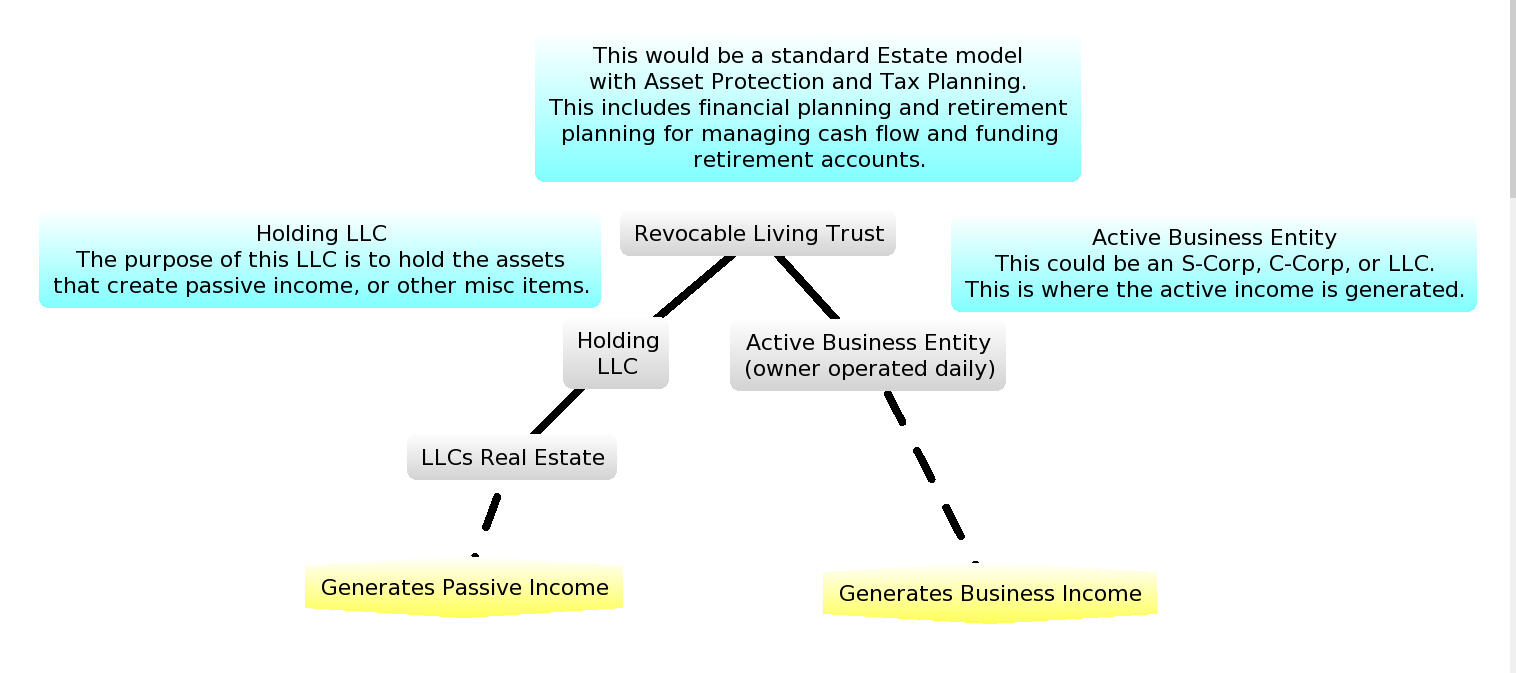

Phase 3 - Standard Model

I used real estate as an example of an external investment since it's so common, but it could be anything.

PAUSE HERE

So far this has been a pretty standard outline. There is a financial planner, an accountant, an estate attorney, and potentially other professionals involved, even a bookkeeper. There could even be some succession planning done for the active business.The combination of these financial planning services has created an entity structure, or model, that looks fairly standard. However, what does this model resemble? It looks EXACTLY like the model used for starting a Small Business Holding Company for M&A Expansion.But, we've arrived at two major hurdles that so many businesses owners never get past, and this prevents the standard model from being used for M&A expansion.1. They are stuck working in the business, generally as part of the day-to-day operations, and therefore don't have the available time or capacity to do more.2. There's an unrecognized "something" that is wrong with their business that limits it's selling value and the owners ability to exit. In other words, something about the business prevents a buyer from wanting to buy it, or being able to buy it. This is why so few businesses are ever able to sell, and understanding how to solve this problem is what opens the door to M&A activities and allows the owner to properly exit the business from an operational perspective.The next phase is about solving these two problems.

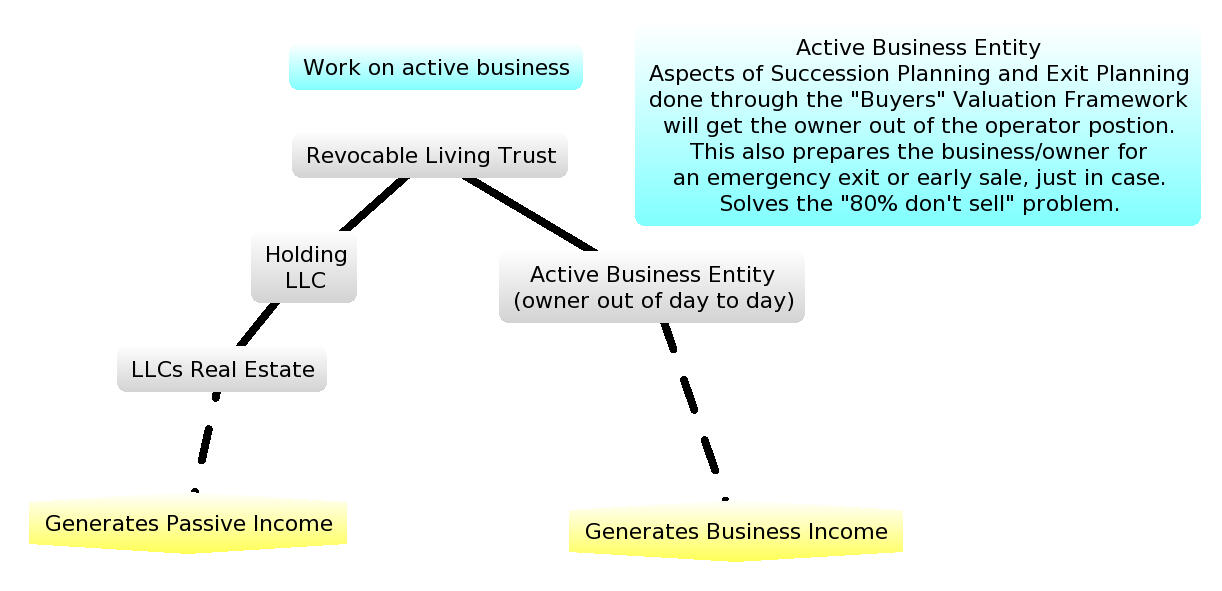

Phase 4 - Transition

This phase is all about the owner and their business, and making sure the business has the right set of characteristics. This is generally not part of the standard approach to long term planning. But, for the model I am describing, this is a mandatory step.

PAUSE HERE

There are three very important things to notice.1. The model is structurally ready for M&A expansion.2. Applying the Buyers Valuation Framework to the operating business means the owner has gotten out of the day to day operation and has time to spend on other activities, and the owner now understands how to run a management team as well as the basics of business buy/sell valuations. This puts the owner in the perfect position to grow using a Small Business M&A plan.3. The operating business is profitable enough that excess cash flow can be used to fuel M&A expansion. (It doesn't take much)One thing to notice: All of these points are in perfect alignment.Important: Moving from Phase 4 to Phase 5 is where the model expands beyond the more traditional "financial planning" approach.

Service Summary

(Just a rough example, and there is absolutely cross over between providers since everyone basically helps with everything in some way. This cross over is why the "internal team" approach is so critical.)Financial Planner: Financial Planning, Retirement Planning, Wealth/Investment Management, Cash Flow and Debt Management, Insurance Guide, more.Attorney: Estate Planning, Entity Selection, more.Accountant: Tax Strategy, Tax Prep and Filing, Bookkeeping, more.Matt's Part: M&A Guide, Valuations, Succession/Exit Planning, Biz Development, more. (Note: these services are all done in a way that fits within the general M&A perspective)

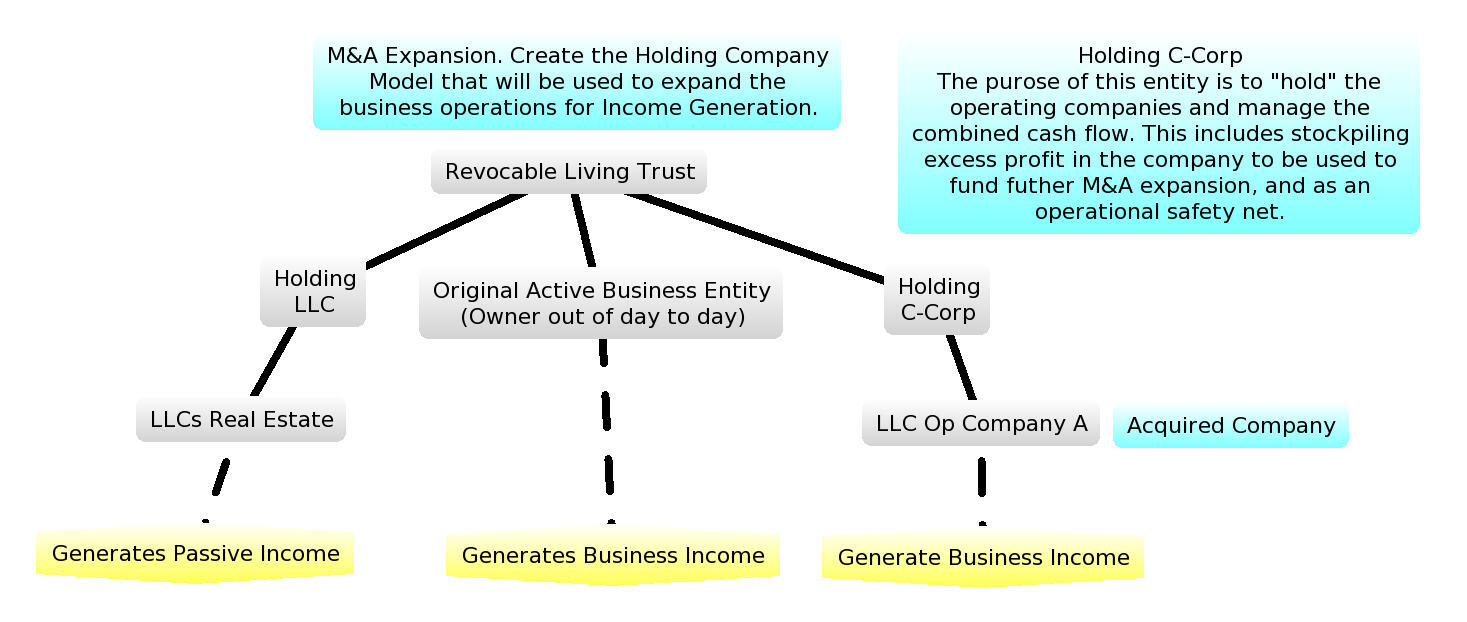

Phase 5 - Expanded Model

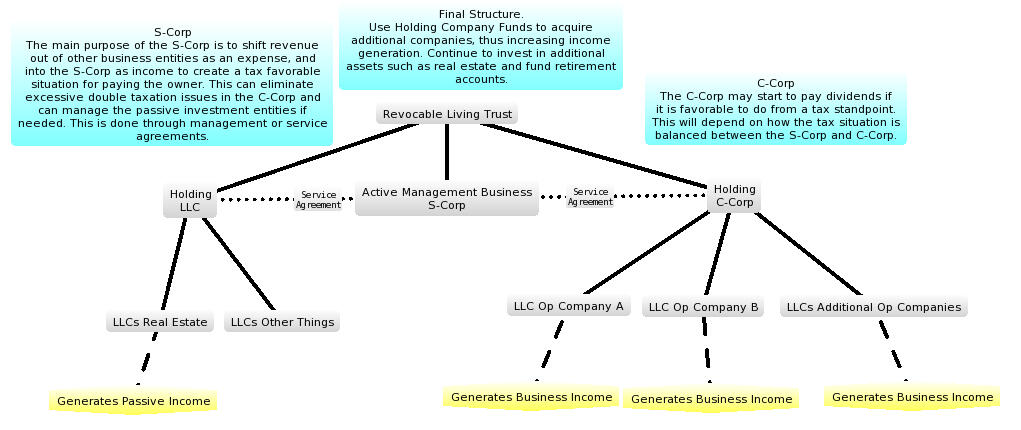

The focus here is on the first acquisition and creating the holding company that supports the M&A activities. There are other ways this could look, but this example is easy to understand.

PAUSE HERE

The main services that can be added here are a Buy-Side M&A attorney and an Accountant familiar with financial due diligence. There are some options for how to make the transition from Phase 5 to Phase 6, but they are beyond this simple description and tough to diagram.

Phase 6 - Expanded Model

This is the basic structure of the final version. Yes, this could look different or more could be added, but the point is to keep it simple for now.